Morning Star candlestick is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend.

This is one of the popular candlestick patterns used by many technical analysts.

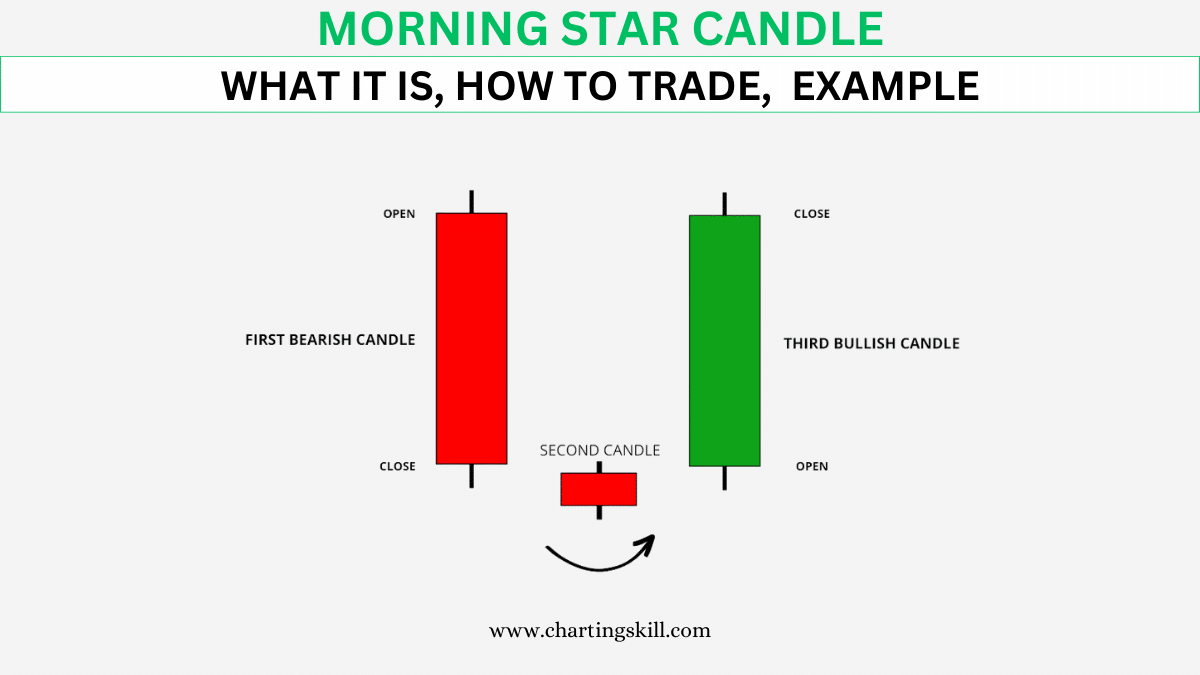

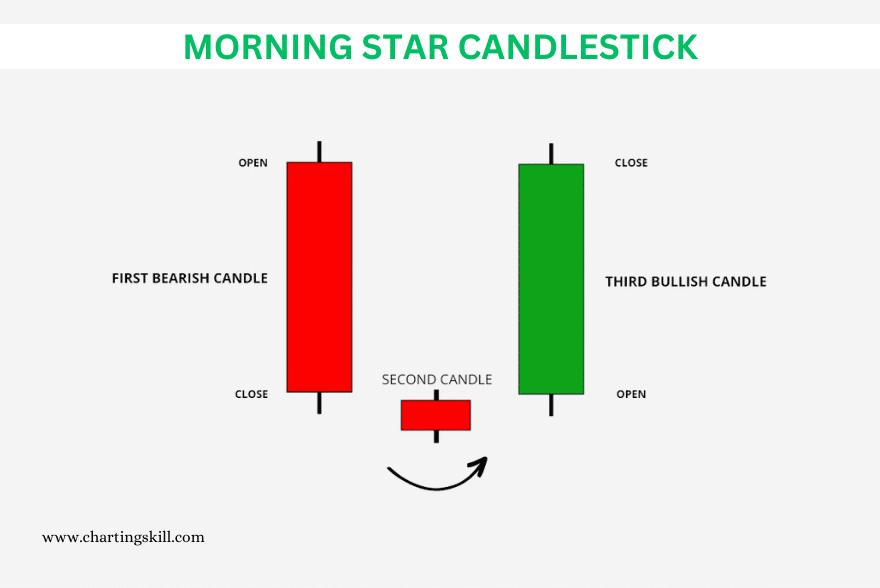

Morning Star pattern consists of three candlesticks: a big red candle, a small doji candle, and a big green candle.

This is one of my favorite candlestick patterns I use. There are many candlestick patterns, but these 35 powerful candlestick patterns are so popular.

What Is a Morning Star?

Morning Star is a bullish candlestick pattern. This pattern indicates a trend reversal from down to up.

This means if this pattern gets formed at the bottom of the downtrend, then it reverses the trend to up.

Morning Star has three candlestick patterns: a big red candle, a small doji, and a big green candle.

You might get confused sometimes while trading this pattern. If you trade this pattern at the wrong location, then it’s most likely that your stop loss will get hit.

The opposite candle of the Morning Star is the Evening Star Candlestick Pattern.

The Morning Star pattern is a bullish reversal pattern, but the Evening Star candle is a bearish reversal candlestick pattern.

What Does a Morning Star Tell You?

A Morning Star Candle is a bullish reversal pattern in technical analysis that signals a potential trend reversal of a downtrend.

It is made up of three candlesticks, with the first being a long red candlestick, the second being a small candlestick, and the third being a long green candlestick.

The first red candle indicates that the downtrend continues, and sellers drive prices down.

The small candlestick in the middle is a Doji, which indicates indecision among the buyers and sellers.

The third long green candlestick indicates sellers are powerless to drive prices down, and buyers are taking control and increasing prices.

How to trade a morning star?

Morning Star candlestick is a bullish reversal pattern, so this pattern works in a downtrend.

We must seek opportunities to make money with this pattern in a downtrend, but in a downtrend, people make many mistakes and fail to trade with this pattern correctly.

To trade a morning star pattern, you should first look for a downtrend in the price. The first candlestick in the pattern should be a long bearish candle, followed by a small bullish or bearish candlestick (Doji).

Finally, the third candlestick should be a long bullish candle that closes above the midpoint of the first candlestick.

Once you identify a morning star pattern, you can enter at the close of the third long bullish candle or pullback/retest.

I prefer entering at closing cause, most of the time, there is no pullback/retest in price after morning star candle formation.

After entry, you should place a stop-loss order below the low of the morning star candlestick and set a profit target based on your risk-reward ratio.

Example of Morning Star

Example 1

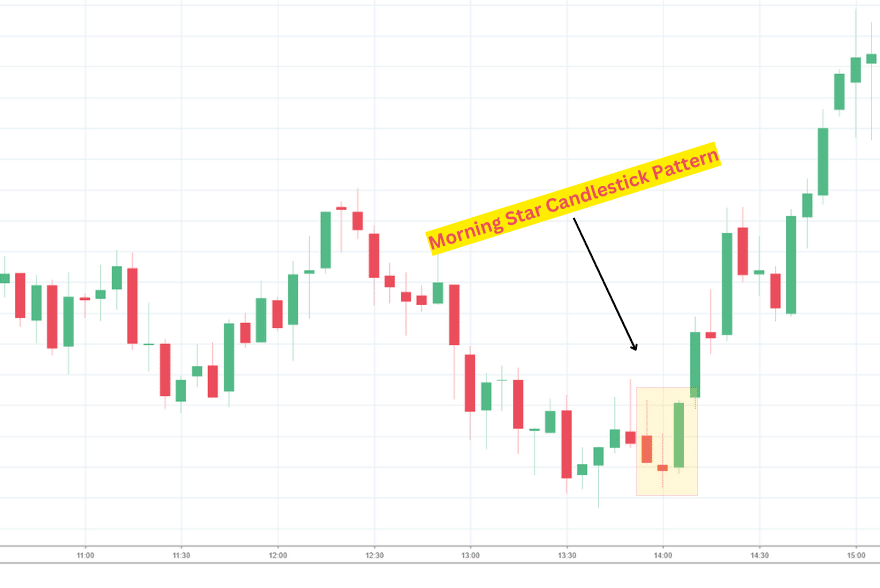

As you can see in the first example, the price was in a downtrend, continuously making Lower-High and Lower-Low.

Suddenly, after the last lower-high price stopped and made a higher-low and at it, we can see the Morning Star Candle, in which we can enter the closing of a third green candle and add stop loss below the low.

Example 2

In the second example, we can see that the price was again in a downtrend, and now, at a lower low, it forms a morning star candlestick pattern.

Here again, we can enter the closing of a third green candle and add stop loss below the low.

Morning star vs. Evening star

The Morning Star and the Evening Star are like two sides of the same coin.

Morning Star is a bullish reversal candlestick pattern, while Evening Star is a bearish reversal candlestick pattern.

We use the Morning Star pattern to identify potential buy signals during downtrends, while we use the Evening Star pattern to identify potential sell signals during uptrends.

Limitations of the Morning Star Candlestick

Morning Star is a commonly used bullish candlestick pattern due to its high win ratio. But in the end, it’s just a candlestick pattern based on price action, and in the market, there are 50:50 possibilities like a coin toss.

It also fails sometimes, and that’s why we should always use proper stop loss and risk management while trading.

We should always use the Morning Star candlestick with other factors on the chart, such as support-resistance, price action, trend, etc., which are also involved in one successful trade.

It’s important to keep in mind its limitations. Morning Star patterns may not always be accurate and can produce false signals, especially in volatile markets.

Therefore, using the Morning Star candlestick in conjunction with other technical indicators and analysis is important to make informed trading decisions.

Things to Consider

Morning Star is a bullish reversal candlestick pattern. To make it profitable, here are some things to consider before trading with the pattern:

- Morning Star is a bullish reversal candlestick pattern, so we should always trade this in a clear downtrend.

- Confirming that the pattern has formed before entering a trade is important.

- The morning star pattern is a strong signal of a bullish reversal. However, using additional tools to confirm your trade is always a good idea. This can include trend lines, support-resistance, or other technical indicators.

- As with any trade, setting appropriate stop loss and taking profit levels to manage risk and maximize potential profits is important.

Conclusion

The Morning Star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend.

This pattern reverses the downtrend to the uptrend. It consists of three candlesticks: a big red candle, a small doji, and a big green candle.

With a high winning ratio, this pattern can be effectively utilized in trading.

Frequently Asked Questions (FAQ)

Is Morning Star bullish or bearish?

Morning Star is a bullish reversal pattern in technical analysis. It consists of three candlesticks that show a shift from a downtrend to an uptrend.

How do you identify a Morning Star?

To identify a Morning Star Candlestick, look for a downtrend in the price. It consists of three candles: a big red candle indicating the seller’s power. The second is a small Doji candle. Finally, the third candlestick should be a long bullish candle that closes above the midpoint of the first candlestick.